Bitcoin will never be a stable currency

People are interested in Bitcoin for two reasons:

- It allows any two willing parties to transact directly with each other without the need for a trusted third party.

- It is an inflation-free asset, hard money, which is assured to preserve your purchasing power over time.

I think that the first argument is basically sound, and the second one basically not. The psychological problem with Bitcoin being only a payment network, however, is that Bitcoin qua payment network can be objectively measured and compared against other payment networks. And if it can be weighed in the balances, it can be found wanting.

For this reason, is it psychologically necessary for its most hardcore promoters to find a sui generis rationale for why Bitcoin is unique. Enter, store of value.

Bitcoin is not currently a stable currency

Does Bitcoin currently help us attain the political goal1 of “sound money”? Is Bitcoin currently a currency free of inflation?

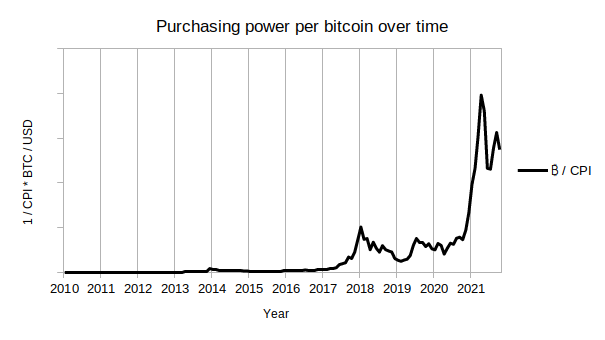

De facto, no. Inflation is conventionally defined as prices going up - the same amount of money giving you less purchasing power. Bitcoin does not, evidently, hold a constant amount of purchasing power:

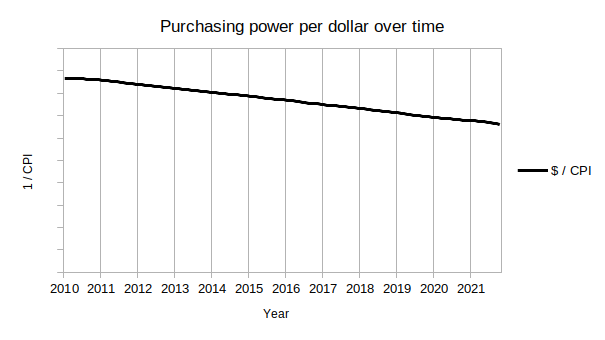

The United States dollar does not, strictly speaking, do this either:

However, the tracking is clearly much more accurate. For the U.S. dollar - I actually calculated this - annual inflation has stayed between 2.30% and 3.08% between 2011 and 2020. For Bitcoin, during the same period, it has ranged between -98.26% and 312.24%. This is not, by any definition, stable. If this were a third world country, you would be laughing at it. Thus, we can not honestly say that Bitcoin - to date - has accomplished the goal of being a stable store of value.

There’s two main objections to be made here:

- The goal is not to preserve purchasing power, but to have a currency with a constant money supply.

- Bitcoin will become stable in the future.

The first objection is plainly absurd. What do you need a currency with a stable money supply for? Is it needed to have a non-inflationary currency? If so, that’s your real goal, and keeping the money supply stable is merely a means to an end.

If not - if you don’t care about inflation, but are deeply concerned about increases in the money supply, what’s the point? Is there an intrinsic value, detached from all other considerations, in having a currency whose money supply doesn’t budge? What’s going on here? If you know, please send me an e-mail immediately!

But the second objection is more interesting.

Bitcoin can never become a stable currency

People seem to have some notion of Bitcoin becoming stable with increased adoption. They theory is that, at some unspecified point in the future (with “adoption”), people will start pricing goods in Bitcoin. When that happens, Bitcoin will become a “unit of account,” volatility will plummet, and Bitcoin will suddenly be as stable as the dollar or the euro.

Their problem is that you can’t just build a runway and a control tower and wait for the planes to land. You actually have to understand the underlying reason for why the planes decided to land on your island and so on.

Some theory

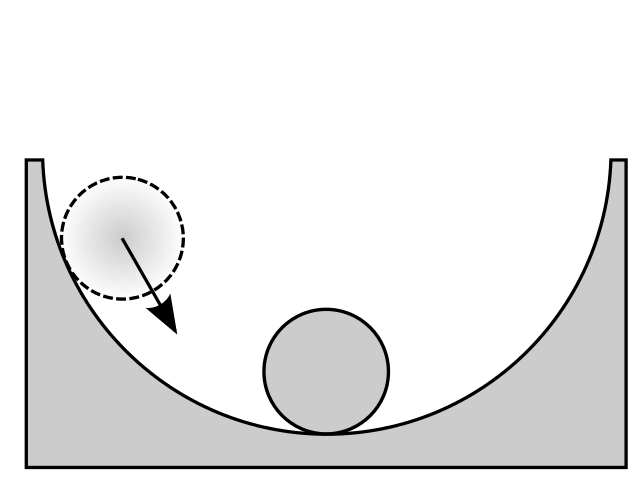

What does it mean for something to be stable? Looking at it from a distance, it’s quite obvious: something is stable if it has a tendency to stay in on place. But let’s look at it up close. What causes this die to be stable? Why doesn’t it just fall over, or start moving to the side?

The question is almost too stupid to even be able to consider it, right? If you tipped it over a little bit to the side, it would fall back down again. This is what’s called a stable equilibrium2. And here’s a literal textbook example of a stable equilibrium:

To plagiarize Wikipedia:

A system is in mechanical equilibrium at the critical points of the function describing the system’s potential energy. We can locate these points using the fact that the derivative of the function is zero at these points.

The derivative of a function means the slope of that function. If the derivative of the potential energy (with respect to a change, like pushing the die) is zero, that means the die doesn’t want to go any particular way if I don’t push it. If it’s also at a local maximum, it means things now are the best they can be, and so will want to go back to the way things were if I push it. 3

Some practice

We can trivially extend this to currencies: what would happen if the U.S. dollar crashed by 90% tomorrow, without any underlying change in the economy? Obviously, any goods priced in dollars would instantly become ten times cheaper, causing foreign consumers to buy more American goods4, causing an inflow of foreign currency into the American economy. This inflow would strengthen the dollar. It would stop approximately when the dollar reaches its natural exchange rate.5

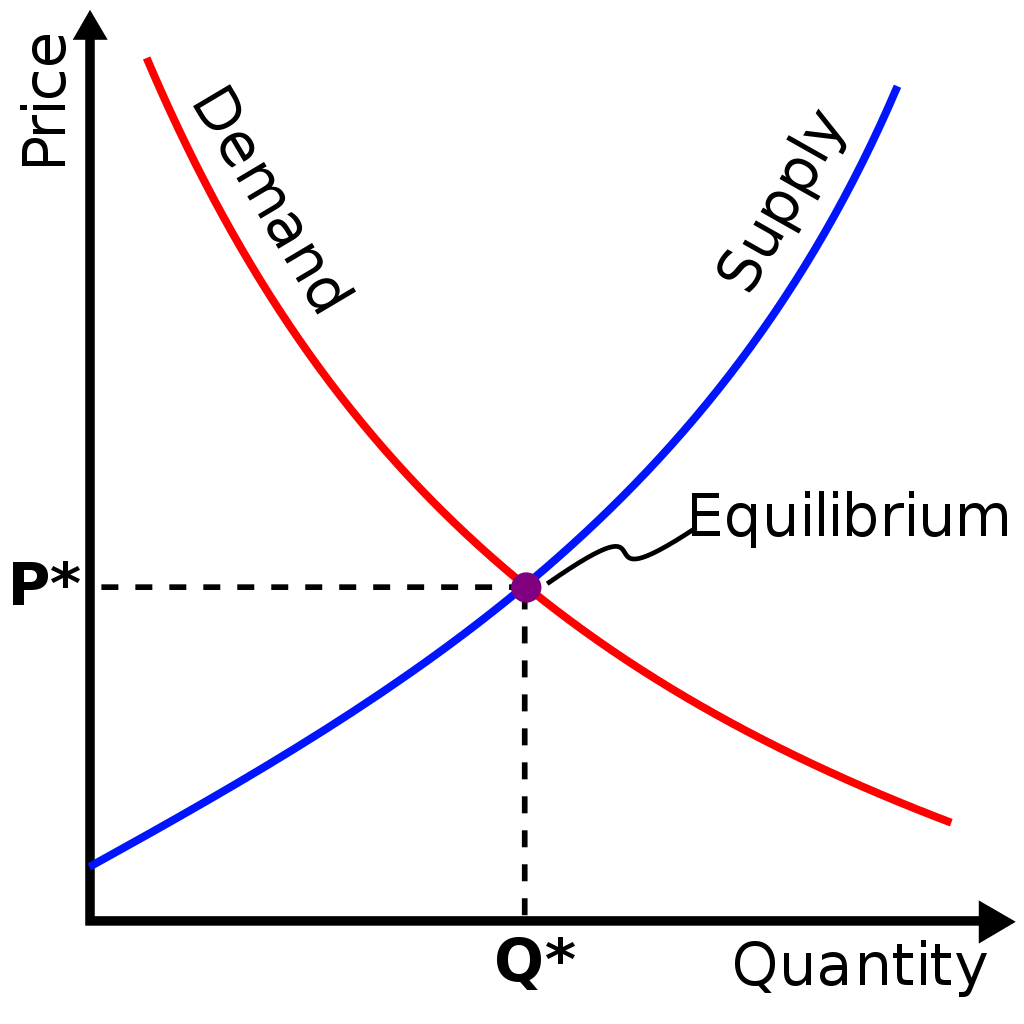

In other words, there’s a negative feedback loop. If the price goes down through some exogenous shock, it will go back up again, and vice versa. We can look at this through the lens of the good old supply and demand curve:

The dollar is both supply and demand elastic. The demand for U.S. dollars varies by price as discussed above, but the supply (i.e. the interest rates) is also centrally planned in pursuit of the dual mandate of price stability and maximum sustainable employment.

Does Bitcoin have an elastic supply?

Not in the primary market. The money supply is not affected by the current price. A higher price does not cause more Bitcoins to be mined. The money supply equals, regardless of anything else:

This converges to a finite value, the famous 21 million. Moreover, the current value depends only on the time (i.e. the block height, ), and nothing else.

There is also a second-hand market. If I hold Bitcoin, I may be willing to sell at some price, but not some other. If I’m trying to maximize my profits in fiat terms, I want to sell at the highest price I can get. That decision depends on the price, but also on my expectations of the future price. (If I’m trying to maximize my profits in Bitcoin terms, I may still want to buy and sell, if I believe it will decrease temporarily to rise later.)

Does Bitcoin have an elastic demand?

No. Nobody has a price-related demand for Bitcoin: nobody buys 0.00170844 Bitcoin, they buy $100 worth of Bitcoin.

If the price goes up, that doesn’t actually price anyone out from buying (as we are helpfully reminded, Bitcoin is divisible down to 10^8 satoshi, so you can buy very small amounts indeed), and if it goes down, it doesn’t make a single person any more able to afford Bitcoin. Yes, it makes them able to buy more Bitcoin for the same amount of dollars, and it makes a specific amount of Bitcoin more affordable in dollar terms, but a lower price doesn’t make them buy more Bitcoin in value terms.

I should note that I’m not really making a psychological point here: even if everyone thought of it in terms of buying Bitcoin, their demand would still not be price-sensitive, except inasmuch as they’re buying a constant amount of it in fiat terms, which is the point I’m making.

Furthermore, from what I can determine, people seem to buy Bitcoin on basis of what they think will happen to the price in the future, which they base on news reports and the like.

If this is true, it would suggest that the price of Bitcoin depends only on the expectation of future price. This is basically the Matt Levine theory that crypto is a bet on attention.

Anyway, note how this differs from gold:

- If gold drastically increases in price, previously unviable mines open again.

- If gold drastically decreases in price, certain mines will immediately close.

- If gold slightly increases in price, less jewelry and electronics will be produced using gold.

- If gold slightly decreases in price, more jewelry and electronics will be produced using gold.

If Bitcoin would have goods priced in it, none of this would be a problem. Either if enough people started to do it - see below - or if the protocol6 intrinsically had some way to burn bitcoins in exchange for, let’s say, increased block space. In that case, cheap bitcoins would mean cheap whatever, which would (theoretically) stimulate capital inflows.

But it doesn’t, so it is. With an entirely fixed supply and a totally price-insensiive demand, Bitcoin is at best astable.

What would Bitcoin look like, if it were stable?

It would have a supply and demand curve where the lines crossed at an angle. Since the supply will always be flat, the demand would have to decrease as price goes up.

This is where we come to the “goods being priced in Bitcoin” part. Pricing a good in Bitcoin can mean two things. To quote Nassim N. Taleb:

There is a conflation between “accepting bitcoin for payments” and pricing goods in bitcoin. To “price” in bitcoin, bitcoin the price must be fixed, with a conversion into fiat floating, rather than the reverse.

There’s two ways to skin a cat. You can either sell something for, let’s say, $100, and then convert that into 0.00170844 bitcoins for your website. Or you can sell something for 0.00100000 bitcoins.

In both cases, I’m pricing goods in Bitcoin. But only one of these contributes to the stability of Bitcoin.

If you’re automatically converting prices, then you’re just using Bitcoin as a payment processor. As Bitcoin goes up or down, the sales of your product will not change, because the price will change accordingly. But if your prices are fixed in Bitcoin, you will add it some stability. If Bitcoin is cheap, getting $100 worth of goods for $50 is a steal, so your sales will go up (and money will flow into Bitcoin). If Bitcoin is expensive, getting $100 worth of goods for $200 is an awful deal, so your sales will dry up (and less money will flow into Bitcoin).

If you do this, you are acting as a buyer of last resort. It is worth noting that this is how the United Kingdom lost £3.3 billion on Black Wednesday. If you’re spending money to prop up the market, unless you’re richer than the market, you will eventually run out of money before they do.7 In economics, this is known as the Impossible Trinity, which states that it is impossible to have all three of the following at the same time:

- fixed foreign exchange rates

- independent monetary policy

- free movement of capital

The explanation is as follows:

- Without fixed foreign exchange rates, we can alter our exchange rates to conform to the world market

- Without independent monetary policy, we can alter our interest rates to concorm to the world market

- Without free capital flows, we can uphold a discrepancy between the two

In practice, I think Bitcoin is much worse than even third world currencies here. They’ll have some centralized authority making some effort to uphold the currency. But since Bitcoin is trustless, there is no such authority.8

Even aside that, there is the other problem: there’s almost nobody who holds Bitcoin for mundane reasons9 in the same way that companies hold checking accounts of U.S. dollars. This would mean precisely all the investment activity, which governs the price, is based on confidence, or expectations of future price.

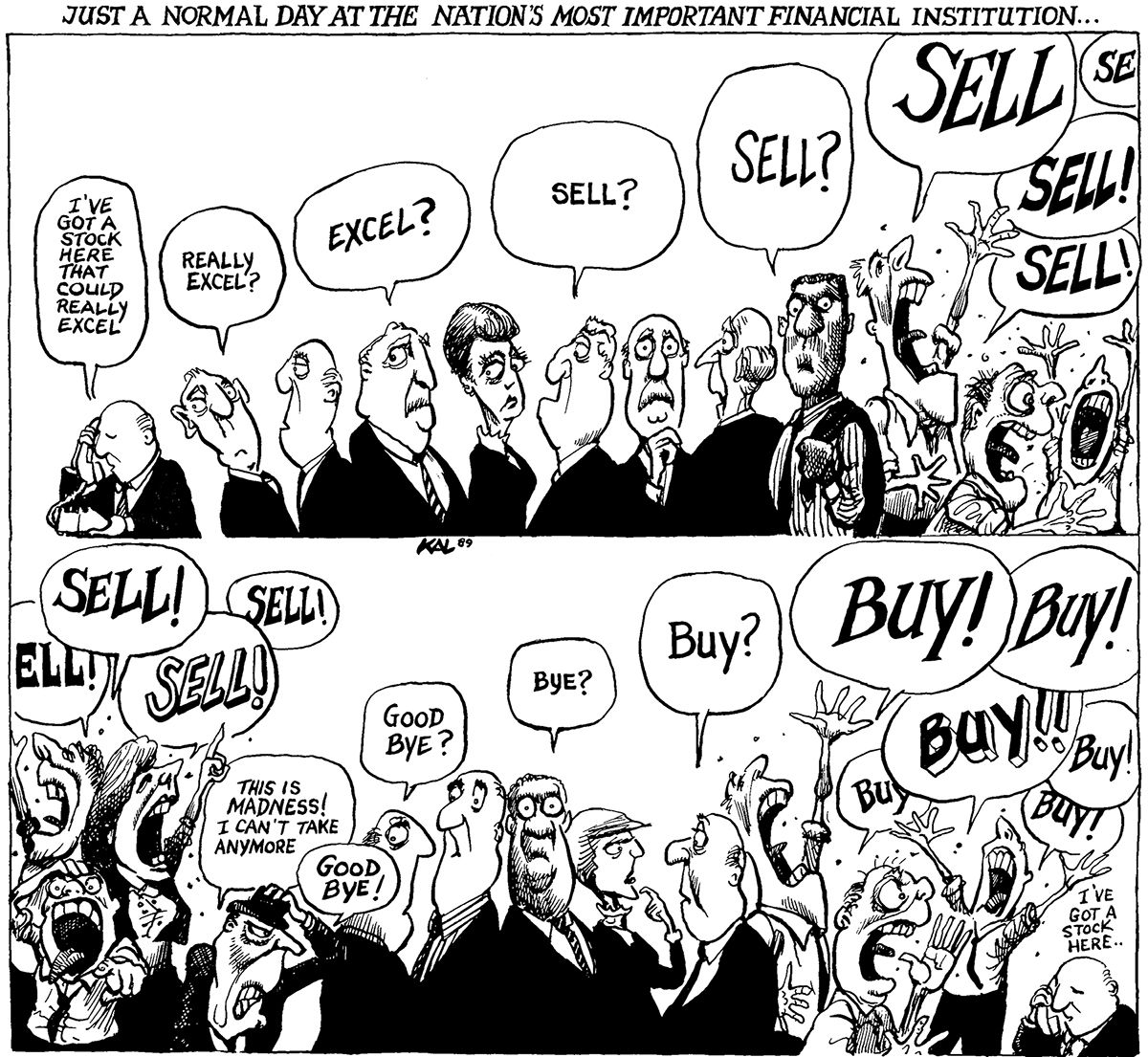

If that’s true, it suggests Bitcoin is not just astable, but even unstable: if the price goes down, it will go down even more, because of the panic10, but if the price goes up, it will go up even more, because of the mania. As Kevin Kallaugher for the Baltimore Sun puts it:

.

I am not implying that such a thing is universally considered to be desirable, but merely that it is a goal held by some.↩︎

Well, if you tipped it over more than 45° it would fall down the other way. Exactly at 45°, you have what’s called an unstable equilibrium.↩︎

If it’s at a local minimum, it means literally anything is better and so it’s unstable. If it’s neither, it means it doesn’t care as to which.↩︎

This is also why states want to manipulate their currency to be weak.↩︎

Which would, ceteris paribus, be whatever it used to be.↩︎

This is not intended as an endorsement of any other cryptocurrencies which may have such a monetary policy.↩︎

For this reason, the theory that big banks’ market making desks will voluntarily do this also strikes me as somewhat unlikely. Why would a bank stand willing to buy Bitcoin at some arbitrary price point but not at some other in the absence of an arbitrage condition? First of all, they don’t like to lose money, secondly, they’re all long volatility.↩︎

Other than Tether, maybe.↩︎

No, Michael Saylor of MicroStrategy fame is everything but mundane.↩︎

The recent event(1) (2) on December 4 when a market sell of 1,500 BTC caused 4,000 BTC worth of liquidations, in turn causing a broader loss of confidence in the currency, may be illustrative.↩︎